Irs Form 709 2025 – If any of the above conditions apply, that individual must file a gift tax return (form 709) even if a gift tax is not payable. This form is essential for ensuring compliance with federal tax laws regarding gifts and transfers. In 2025, d gives a gift of $20,000 cash to b and no other gifts. Form 709 is used to report (1.

For example, gifts made in 2025 must be reported by april 15, 2025. As mentioned above, attempts to fill in gift descriptions using the pdf form for the 709 provided by the irs were often futile. Irs form 709 must be filed every year that gifts worth more than the excluded amount were made. With upcoming changes in estate tax laws in 2026, 2025 is an ideal.

Irs Form 709 2025

Irs Form 709 2025

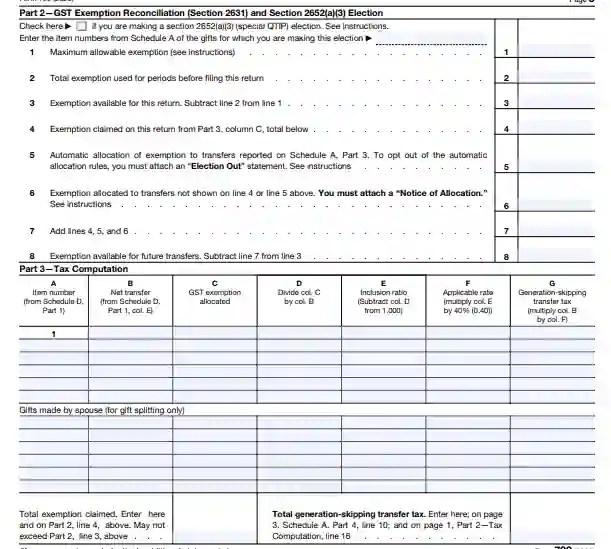

Form 709 for 2025 must be submitted by this deadline, with an extension available via form 8892. We need the information to figure and collect the right amount of tax. Use form 709 to report transfers subject to the federal gift and certain gst taxes.

File before april 15, 2026: Form 709 and gift tax planning, along with clear instructions, are critical tools for minimizing estate taxes and ensuring smooth wealth transfers. Form 709 is due by april 15th of the year following the calendar year in which the gift was made.

For tax year 2025, that’s any gift given by an individual that was over $18,000 in value; If you request an extension for filing your federal income tax return (form 1040), this also extends the deadline for form 709. The annual gift tax exclusion rises to $19,000 per recipient in tax year 2025, and the lifetime exemption to $13.99 million per individual.

A gift tax return is generally not required to be filed if all gifts to various donees do not exceed the annual exclusion amount. A spouse was required to sign the donor’s form 709 if gifts were split, but on the 2025 form 709, the spouse must now sign a notice of consentthat will be attached to the donor’s.

for How to Fill in IRS Form 709

How to Fill Out Form 709

Gift Tax 709 Form r/tax

IRS Form 709 ≡ Fill Out Printable PDF Forms Online

How to Fill Out Form 709 Nasdaq

IRS Form 709 ≡ Fill Out Printable PDF Forms Online

The Ultimate Guide to Form 709 An Intro

2025 Instructions for Form 709

Gift Splitting Explained An Overview, Tax Rules, and Examples Consilio Wealth Advisors

How to Accurately Prepare the 709 Gift Tax Return Update for 2025 Returns Ultimate Estate Planner

Example of Form 709 Filled Out UPDF

Help with Form 709

Do I have file a gift tax return 20242025? (Form 709)

United States Gift (and GenerationSkipping Transfer) Tax Return Sign Here

IRS Form 709 Tutorial for 2025 Gift of Bitcoin YouTube